Preamble

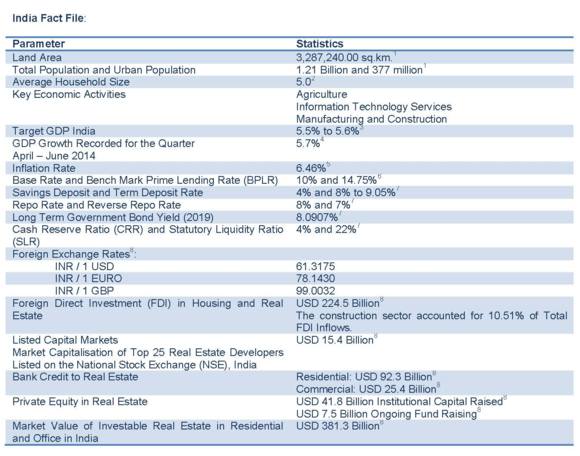

‘India’ being the land of opportunities for doing global business has opened doors to several international players to invest in the real estate and construction sector across the country. With an estimated known population of 1.21 billion and the economy back on a track with GDP recorded at 5.7% in Q2, 2014 from the erstwhile slowdown of 4.7% in Q2, 2013, the country is now all poised to witness growth ahead. During the recent lok sabha (lower house of the parliament) elections of May 2014, India has been successful in having a new stable government with the Bharatiya Janata Party (BJP) evolving as the single largest party (about 52% of the total 545 seats) having its seat in the parliament under the leadership of a vision-ary prime minister ‘Modi’. This has significantly reduced the talked about political risk in the country as opposed to the erstwhile Government which was in a state of policy paralysis during the past few years. The formation of new government has triggered positive sentiments to the growth of the economy.

Per the Central Statistics Organization (CSO) data, during Q3 2006 and Q3 2009 India’s GDP recorded was the highest at 9.8% and over the years since then witnessed a gradual deceleration with the lowest growth rate recorded at 4.6% during Q4, 2013. Some of the reasons attributed to this fact are the global slowdown, high interest rates and inflation, lack of overseas credit, sluggish domestic activities/low industrial output and weak private-sector investment.

Rapid urbanization, positive demographics (young population and growth in nuclear families), rising income levels and growth in the manufacturing and services sector being the key enablers have paved way for the Indian real estate sector to attract investments largely in the form of FDI from all parts of the globe as well as domestic capital within the country.

Union Budget India 2014-15 Highlights for Real Estate Sector

The recent union budget of July 2014 had positive announcements for the real estate sector and some of the key considerations are as below:

- Relaxation of FDI conditions for real estate / construction-development projects

- REIT and Infrastructure Investment Trust tax pass through status

- Development of 100 smart cities in India with allocation of Rs. 7050 Crores (approxi-mately USD 1.2 Billion)

- Allocation of Rs. 8000 Crores (approximately USD 1.33 Billion) to finance low cost affordable housing through National Housing Board (NHB)

- Road and highway development (urban transportation) through 3P model (Public Pri-vate Partnership). An investment of Rs. 37880 Crores (approximately USD 6.3 Billion) in the National Highway Authority of India (NHAI) with a target to construct 8500 kms of national highways during the current financial year (2014 – 15)

- Special Economic Zones (SEZ) as an instrument towards better infrastructure and land utilization

- Rural Infrastructure Development Fund (RIDF) corpus at Rs. 30000 Crores (approxi-mately USD 5 Billion

- FDI allowed in Manufacturing and Defence up to 49% with Indian management and control under the Foreign Investment Promotion Board (FIPB) route

Classification / Asset Class(s)

The spectrum of real estate in India is primarily as below:

- Residential – Plots, Apartments, Condominiums, Rowhouses / Townhouses and Villas

- Commercial – Office (Built-To-Suit, Multi Tenanted Facilities) and Retail (High Street Shopping Centers, Malls)

- Hospitality – Hotels and Resorts

- Industrial – Logistics and Warehousing Facilities

- Industrial Parks – Including IT Parks under Software Technology Parks of India (STPI) and Special Economic Zones (SEZ) – Multiproduct, Sector specific and Free-trade Warehousing Zone

- Ancillary products in health care, education, recreation facilities to mention a few.

Regulation

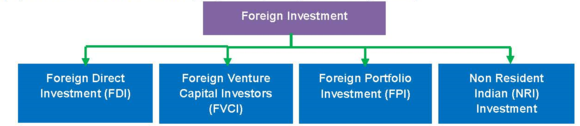

Foreign investments in India are under the jurisdiction of the following regulators:

- Reserve Bank of India (RBI)

- Foreign Investment Promotion Board (FIPB)

- Department of Industrial and Information Policy (DIPP)

If the securities are listed or offered to the public, dealings in such securities is regulated by the Securities and Exchange Board of India (”SEBI”). Foreign investment into India is regulated under Foreign Exchange Management Act, 1999 (“FEMA”) and the regulations there under, primarily Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2000 (“TISPRO Regulations”).

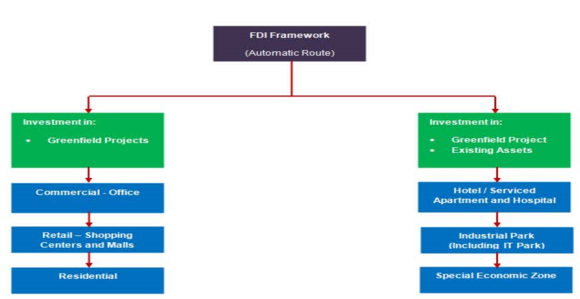

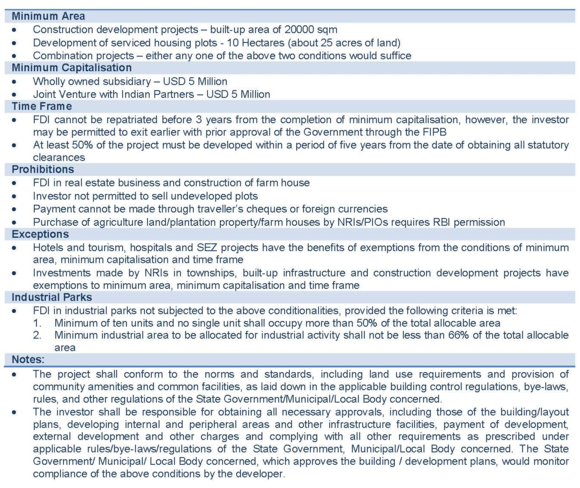

In general, a foreign investor entering / willing to do real estate business in India has to com-ply with the minimum FDI norms stipulated by the Government of India – Department of Industrial Policy and Promotion (DIPP). In the recent union budget of 2014 -15, the Government relaxed the FDI conditions thus opening doors to foreign investment on a friendly business note. 100% FDI under the automatic route allowed in townships, housing, built-up infrastructure and construction-development projects (which would include, but not be restricted to, housing, commercial premises, hotels, resorts, hospitals, educational institutions, recreational facilities, city and regional level infrastructure). Some of the important FDI guidelines10 now applicable are:

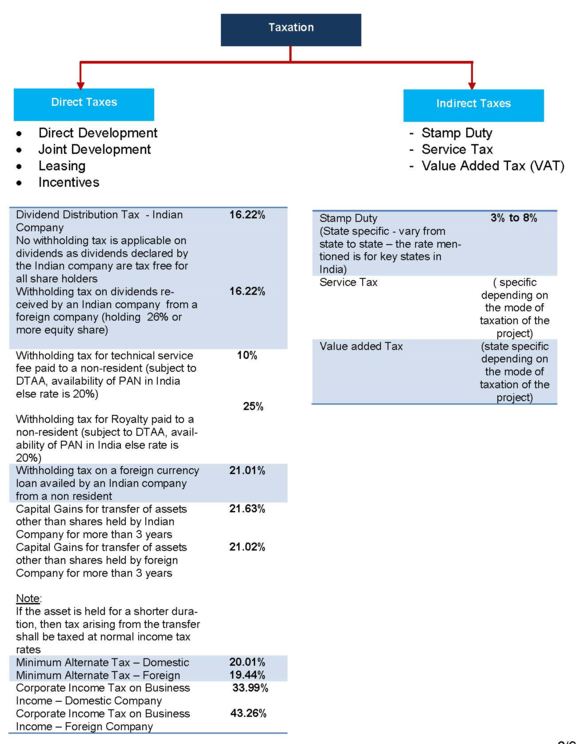

Tax Framework

Tax framework in India – Real Estate Specific

Legal Framework

The Company’s Act of 2013 introduced new provisions with respect to the following:

- Shares with differential rights

- Listed company

- Inter-corporate loans

- Deposits

- Insider trading

- Squeeze out provisions

- Directors

- Subsidiary and associate company

- Merger of an Indian company with offshore company

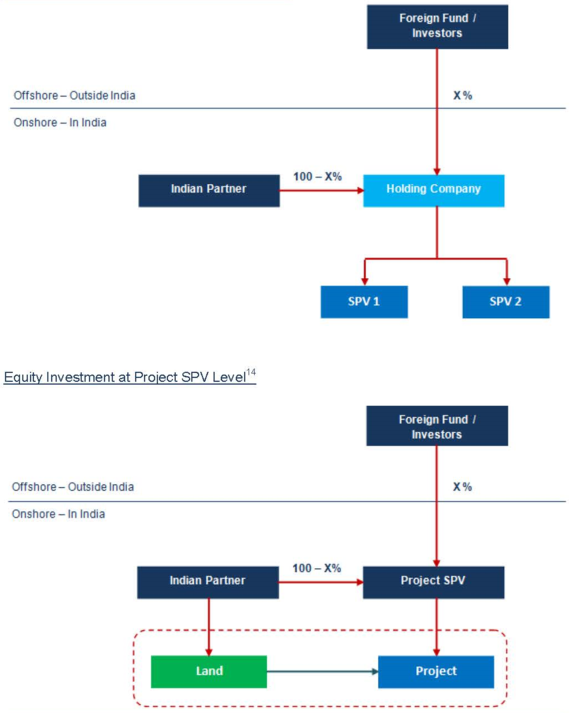

Typical Transaction Structure

Equity Investment at Holding Company Level

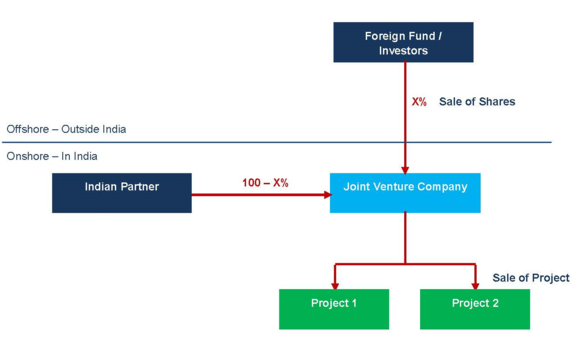

Typical Exit Mechanism – Foreign Company

Key Considerations – Sale of Shares

- Holding period for long term characterization of capital gains – 12 months(only in case of listed securities),in case of Unlisted securities is 36 months

- Long term capital gains tax at 21.02%

Key Considerations – Sale of Project

- Sale of project with holding period for long term characterization for capital gains – 36 months

- Repatriation through dividend, the dividend distribution tax applicable for Indian com-pany at 16.22% / long term capital gains tax at 21.02%

- Transaction costs (state specific depending on the location of the project)

Conclusion

Foreign funds or Investors investing in real estate in India must evaluate potential opportuni-ties with reference to the market - economic, regulatory, legal and taxation framework for safe entry and exit mechanism. The following transaction parameters14 would be of useful substance when considered whilst executing transactions:

- Regulations – foreign investment, capital markets, exit options

- Type of instrument – equity / debt / preference / convertible / FDI / repatriation / taxa-tion

- Deal structuring – commercial structuring / promote structuring / tax structuring

- Taxation – treaty benefits

- Corporate governance – board representation, voting powers, related party transactions

- Exit options – exit through sale in India / dividend distribution / sale of shares at over-seas level / IPO listing

For the sources used we refer to the original publication. First publication: Institute of Revenues Rating and Valuation (IRRV), Valuer edition, page 18-21.

Important note: External authors express their personal opinion. This opinion does not necessarily represent the views of IREBS.